Warning on risks: Financial contracts for difference are complex instruments and are associated with a high risk of rapid financial losses due to leverage. On 72.76% of retail investor accounts, financial losses occur when trading financial contracts for difference with this provider. You should consider whether you understand how financial contracts for difference work, and whether you can afford to take the high risk of suffering financial losses. Please read the Risk Disclosures.

AI Assistance and Changes in Consumer Behavior. What Did Black Friday 2025 Bring?

Revenues grew faster here than in physical stores, and Adobe Analytics reports that this year’s Black Friday was the biggest ever for online platforms. American consumers spent $11.8 billion online, up 9.1% year‑over‑year. Mastercard SpendingPulse reports a 4.1% rise in total retail sales, with e‑commerce driving the sector upward. Physical stores also saw higher foot traffic, typically where retailers combined discounts with bonuses or gifts. However, they still lagged behind the pace of online growth.[1][2]

AI is becoming more integrated into sales

The biggest “winners” according to preliminary data are platforms that implemented AI assistance, personalized offers, or automated product recommendations. RetailDive’s analysis reports that traffic from AI channels grew by around 805%, and these visitors were 38% more likely to convert. This has an immediate impact on companies such as Amazon, Shopify, and tech firms that support AI marketing tools.[3][4]

Shopify

Shopify is a Canadian e‑commerce platform that enables millions of small and medium‑sized businesses to operate their own online stores and accept online payments. The provider reported that merchants on its platform reached a record gross merchandise volume (GMV) of $6.2 billion during Black Friday, representing a 25% year‑over‑year increase. At peak hours, customers were spending more than $5 million per minute. This is a clear sign that a wide range of independent brands on Shopify maximized the benefits of the shopping frenzy. According to Deutsche Bank, this single‑day GMV represents approximately 5% of the quarterly volume, which is consistent with historical patterns. It is therefore not a one‑off spike but confirmation of a growing trend. A strong Black Friday supports the argument that Shopify is among the leading companies benefiting from the rising popularity of online sales. On Monday, December 1, Shopify shares fell by nearly 6%, though this was due to a brief platform outage.*[5]

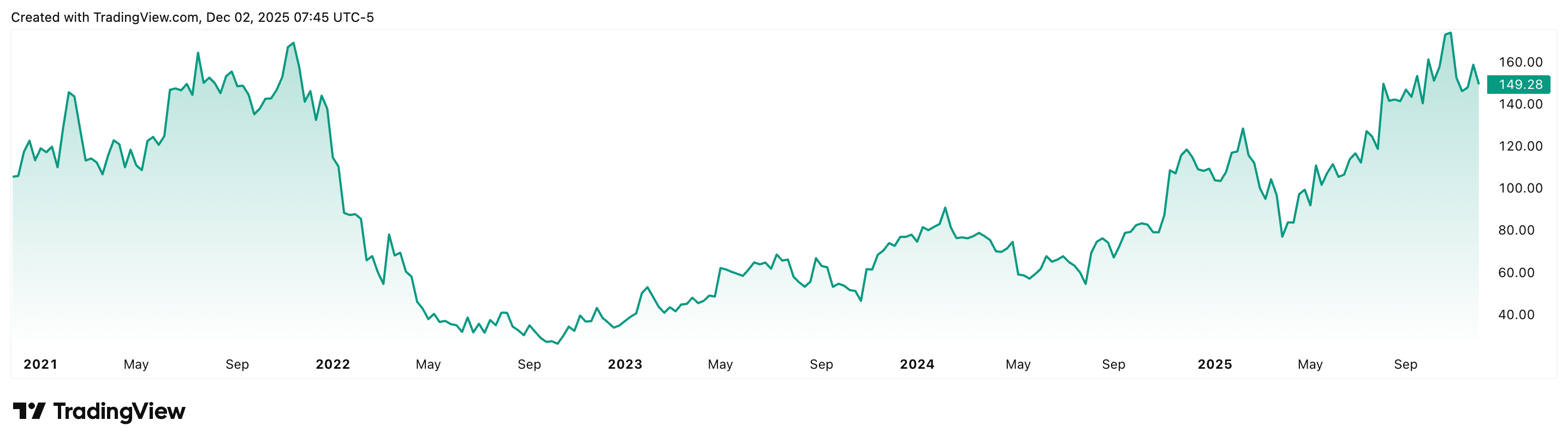

Shopify stock performance over the past 5 years. (Source: tradingview.com)

Walmart

Walmart reported that during Black Friday week (November 25 to December 1, 2025), its orders increased by 57% compared to the previous year. It also stated that its Marketplace (the online section with third‑party sellers) reached a new single‑day record in processed orders. The company noted that customers who used the Walmart mobile app inside physical stores during Black Friday spent on average 25% more than those who did not use the app.[6]

What to expect from other major retail leaders?

One of the companies that benefits most during this shopping surge, particularly given the enormous growth in online purchasing, is Amazon. Although it has not yet released its results, general preliminary data indicate that this year’s Black Friday was likely another record breaker. As the company invests heavily in warehouse automation and AI‑driven search personalization, higher online sales volumes improve its operating margin. For investors, this is a positive signal for annual results, as Amazon’s Q4 traditionally accounts for more than one‑third of its revenue.[1]

For companies that primarily rely on brick‑and‑mortar stores, such as Walmart, Target, or Costco, Black Friday presents a larger challenge, as the competition for customers shifts online and competitive pressure affects margins. Although they are strengthening their online segments, high logistics costs and the aftermath of the pandemic—when many invested heavily in omnichannel solutions—are reducing profitability. High inflation has also caused consumers to buy fewer premium products, even though overall spending increased. Profits may therefore not grow at a pace reflecting record revenues.[7][8]

Conclusion

Black Friday 2025 clearly showed that retail in 2026 will grow through digitalization, personalization of the shopping experience, and the ability to scale online sales. Companies that embraced these trends emerge from Black Friday as winners, and their stock prices may benefit the most. On the other hand, traditional retail is not falling behind completely, but the question for investors is whether it can keep up.[2]

* Past performance is not indicative of future results.

[1,2] Forward‑looking statements are based on assumptions and current expectations that may be inaccurate or influenced by an economic environment that may change. Such statements are not guarantees of future performance. They include risks and uncertainties that are difficult to predict. Actual results may differ significantly from those expressed or implied in any forward‑looking statements.

[1] https://techcrunch.com/2025/11/29/black-friday-sets-online-spending-record-of-11-8b-adobe-says

[2] https://resourcera.com/data/retail/black-friday-sales-statistics

[3] https://www.reuters.com/business/retail-consumer/us-consumers-spent-118-billion-black-friday-says-adobe-analytics-2025-11-29

[4] https://www.cbsnews.com/news/u-s-consumers-spent-a-record-11-8-billion-online-during-black-friday-sales

[5] https://www.investors.com/news/technology/shopify-stock-black-friday-ecommerce-report

[6] https://www.axios.com/local/nw-arkansas/2025/12/02/walmart-black-friday-shopping

[7] https://www.nasdaq.com/articles/battle-black-friday-stocks-amazon-vs-walmart-vs-target

[8] https://www.reuters.com/business/retail-consumer/what-are-shoppers-looking-this-black-friday-2025-11-26