Warning on risks: Financial contracts for difference are complex instruments and are associated with a high risk of rapid financial losses due to leverage. On 72.76% of retail investor accounts, financial losses occur when trading financial contracts for difference with this provider. You should consider whether you understand how financial contracts for difference work, and whether you can afford to take the high risk of suffering financial losses. Please read the Risk Disclosures.

Airbus Secures a Key Victory Over Boeing

About the Company

Airbus is one of the world’s most significant aircraft manufacturers and plays a key role in the global aviation industry. It was established as a consortium of European manufacturers to compete with American firms and has gradually become a leader in commercial airliners, military aircraft, and space technologies. Its portfolio includes a wide range of aircraft, from fuel-efficient models to wide-body A330neo and A350 jets. Airbus is also active in the military technology segment and in the space sector through satellite systems and launch vehicles. The company is known for a complex supply chain spread across Europe, making it an important pillar of European industry and innovation.

The flydubai Order as a Signal of a New Era

Flydubai has committed to purchasing up to 150 A321neo aircraft with an option for an additional 100 units. The value of the order is approximately $24 billion. The A321neo, an efficient aircraft with relatively high capacity, is designed for medium-haul routes and fits precisely into the airline’s plans. The A321neo will enable flydubai to open new routes to Asia, Europe, and Africa. For Airbus, this is a significant shift in its strategy and proof that it can succeed even with customers previously supplied almost exclusively by Boeing. The decision also comes at a time when Boeing is struggling with production and certification issues, creating space for competition. Dubai is also preparing to open the new Dubai World Central airport, which is expected to strengthen the city’s position as a global aviation hub.[1]

Airbus vs. Boeing

It can be said that 2025 has been very successful for Airbus compared with its competitor. Both manufacturers hold a market share of around 45% to 50%, but trends are more favourable for the European company. In October 2025, the A320 for the first time became the most frequently delivered commercial aircraft in the world, surpassing the Boeing 737. Boeing continues to be slowed by resonance of the 737 MAX crisis, supply chain issues, employee strikes, and delays in certifying the MAX 7 and MAX 10. The company has around 400 undelivered aircraft, many of which have been parked for years, placing pressure on its financial performance. Airbus, on the other hand, has firm orders for 8,665 aircraft, providing a stable foundation for expanding production.[1][2][3]

Financial Results

Airbus confirmed its growth momentum in the third quarter of 2025. Revenue reached €17.8 billion and net profit €1.12 billion, with both indicators rising by roughly 14% year-on-year. Profitability was also supported by adjusted operating profit, which increased by about 38%, reaching €4.1 billion over nine months on revenue of €47.4 billion, up 7% from the previous year. These results reflect a higher number of delivered aircraft, as well as a 9% decline in internal research and development spending and favourable currency movements. A weaker point remains cash flow, which was negative by around –0.9 billion euros over 9 months, as Airbus significantly increased inventory and expanded production capacity to handle a strong year-end.[4]

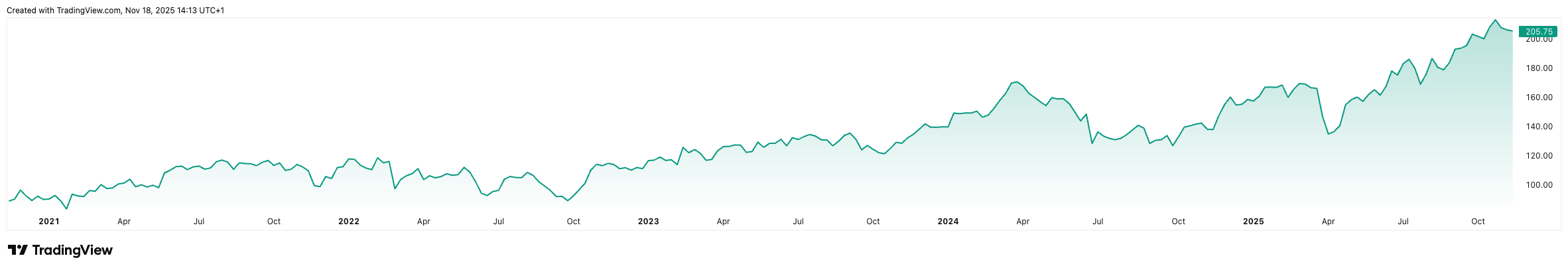

Airbus Shares Have Experienced a Very Strong Period

Over the last year, their price on Euronext Paris (EPA) has risen by roughly 50%, although a slight correction occurred in recent weeks as the shares retreated from this year’s highs above €210 per share.* Deutsche Bank maintains a “buy” rating with a target price of €228 per share, citing robust performance across all major divisions and ongoing increases in commercial aircraft production. After the third-quarter results, Morgan Stanley raised its target price and ranks Airbus among its top picks in the sector, while JPMorgan and other major investment banks maintain “buy” ratings with targets around €235–€245 per share.[2][5]

Airbus stock performance over the past 5 years. (Source: tradingview.com)

Airbus Still Confirms Its Targets for This Year

These now also include the impact of currently applicable tariffs and the planned integration of selected activities from Spirit AeroSystems. The company plans to deliver roughly 820 commercial aircraft, achieve an adjusted operating profit of around EUR 7 billion, and generate free cash flow of approximately EUR 4.5 billion. Strategically important is also the agreement with Leonardo and Thales to merge part of their space activities into a new company. Airbus’s outlook thus combines strong demand for aircraft and growth in defense and space activities with risks posed by the global economy, geopolitical tensions, tariffs, and a still fragile supply chain.[3]

* Past performance is not a guarantee of future results.

[1,2,3] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which is subject to change. Such statements are not a guarantee of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.

[1] https://www.investing.com/news/stock-market-news/flydubai-signs-mou-with-airbus-for-150-a321neo-aircraft-93CH-4364649

[2] https://www.eplaneai.com/news/boeing-and-airbus-compete-in-the-2025-widebody-aircraft-market

[3] https://www.myjar.app/blog/boeing-vs-airbus-financial-analysis-strategic-insights-and-future-trends

[4] https://www.airbus.com/en/investors/financial-results

[5] https://www.investing.com/news/analyst-ratings/deutsche-bank-raises-airbus-stock-price-target-to-eur228-on-strong-q3-93CH-4319006