Warning on risks: Financial contracts for difference are complex instruments and are associated with a high risk of rapid financial losses due to leverage. On 72.76% of retail investor accounts, financial losses occur when trading financial contracts for difference with this provider. You should consider whether you understand how financial contracts for difference work, and whether you can afford to take the high risk of suffering financial losses. Please read the Risk Disclosures.

.jpg)

The World’s Largest Gold Company Awaits Its Investment Moment

About the Company

Founded in 1921, Newmont Corporation has built a century-long reputation as one of the most significant mining enterprises in the world. Its primary focus is gold mining, but it also diversifies into other metals such as copper, zinc, silver, and lead. Today, it operates across multiple continents, including North and South America, Africa, and Australia. Its long-term strategy is based on responsible resource use, technological innovation, and a strong commitment to sustainable development. The company is known as a reliable partner in the mining industry, able to combine growth with environmental responsibility.

Mining in Ghana Running at Full Capacity

Newmont continues to strengthen its global portfolio through new mining projects that expand production capacity while diversifying revenue sources. The company recently announced that its Ahafo North mine in Ghana has transitioned from the testing phase to full-scale production. This is one of the largest mining projects in West Africa and a key milestone in the company’s expansion on the continent. Located about fifty kilometers from the existing Ahafo South mine, it is expected to produce approximately 50,000 ounces of gold this year. From 2026 onward, annual production is projected to range between 270,000 and 325,000 ounces, with an estimated mine life of about thirteen years.[1]

Gold Price Development and Company Valuation

This year, gold has become one of the best-performing commodities in global markets. Following a series of macroeconomic shocks, rising geopolitical tensions, and expectations of lower interest rates, gold surpassed USD 4,000 per troy ounce, reaching new historical highs. Since 2022, its price has more than doubled, significantly boosting mining companies’ revenues and margins.*[2]

Gold futures price performance over the last 5 years (Source: CNBC)

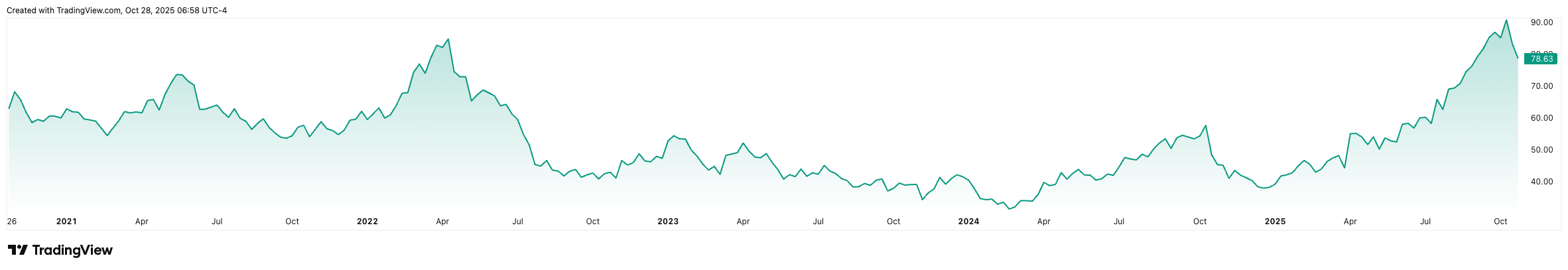

Despite this, Newmont Corporation shares are trading only slightly above 2022 average levels. This means that the market has not yet fully taken into account the positive impact of record yellow metal prices on the company's financial results. This can be a clear signal of undervaluation. Newmont has strong and stable production and the ability to efficiently convert high commodity prices into cash flow, as evidenced by the latest economic results. [2][3]

Newmont Corporation stock performance over the past 5 years. (Source: tradingview.com)

Financial Results for Q3 2025

On October 23, 2025, Newmont released its Q3 financial results, which significantly exceeded market expectations. Revenue reached $5.52 billion, up approximately 20% year-over-year. Net profit rose from $922 million in the same period last year to $1.83 billion, an increase of a staggering 98.7%. Earnings per share rose to $1.71, beating analysts' estimates by more than 19%. Free cash flow reached a record $1.6 billion. The results confirm that the rise in gold prices and improved mining efficiency have a direct and positive impact on the company's financial health. Newmont maintains low debt levels and high liquidity, allowing it to continue investing in future growth and its dividend policy.[4][5]

Outlook

Newmont’s outlook for the coming period remains positive. The company expects demand for gold to stay stable, with high commodity prices enabling it to maintain profit margins even amid rising energy and labor costs. Short-term challenges are mainly linked to planned capital investments and ongoing projects that may temporarily reduce free cash flow. In the long term, however, the company benefits from a unique combination of factors: high gold prices, efficient cost management, and a diversified portfolio of mining sites ensure a strong market position. If gold remains at its current level or continues to rise, Newmont can further strengthen its financial performance and shareholder value in the coming months. The average target price for Newmont’s stock, according to 20 analysts, is around USD 103, approximately 25% above the current market price. Estimates come from reputable institutions such as Goldman Sachs, Scotiabank, UBS, BMO Capital Markets, and others.[6][7]

Conclusion

For investors seeking stability in times of global uncertainty, Newmont Corporation represents a combination of safe haven and growth potential. Gold is reaching all-time highs and demand for it remains strong, creating an environment in which mining companies with solid foundations can thrive in the long term. As the world's largest gold producer, Newmont is uniquely positioned – it has an extensive portfolio of assets, a strong financial balance sheet, and a proven ability to turn high gold prices into profits. [3]

* Past performance is not a guarantee of future results.

[1,2,3] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which is subject to change. Such statements are not a guarantee of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.

[1] https://www.investing.com/news/company-news/newmonts-ahafo-north-project-in-ghana-achieves-commercial-production-93CH-4308656

[2] https://www.gold.org/goldhub/gold-focus/2025/10/gold-hits-us4000oz-trend-or-turning-point

[3] https://www.reuters.com/business/gold-miners-set-bumper-profits-after-bullions-record-rally-2025-10-22

[4] https://www.reuters.com/business/gold-miner-newmont-beats-quarterly-profit-estimates-2025-10-23

[5] https://www.newmont.com/investors/news-release/news-details/2025/Newmont-Reports-Third-Quarter-2025-Results-and-Improves-2025-Cost--Capital-Guidance/default.aspx

[6] https://www.investing.com/equities/newmont-mining-consensus-estimates

[7] https://seekingalpha.com/article/4833354-newmont-solid-free-cash-flow-generation-but-underwhelming-per-share-growth