Upozorenje na rizike: Financijski ugovori za razliku (CFD) složeni su instrumenti i povezani su s visokim rizikom brzih financijskih gubitaka zbog poluge. Na 72.76% računa malih ulagača dolazi do financijskih gubitaka pri trgovanju CFD-ovima s ovim pružateljem. Trebali biste razmotriti razumijete li kako CFD-ovi funkcioniraju i možete li si priuštiti visoki rizik financijskih gubitaka. Molimo pročitajte Obavijest o rizicima.

iPhone 17 Triggered Apple Stock Surge. Can the Company Reach a $4 Trillion Valuation?

About the Company

In recent months, Apple has made significant advances in the field of artificial intelligence (AI), which it had previously developed in a more conservative manner. With the Apple Intelligence platform, the company entered a new phase that combines AI with its device ecosystem and a strong emphasis on user privacy. Features such as real-time translation, visual image analysis, and an improved Siri assistant are the first steps in a broader strategy to bring AI into everyday use. Rather than quick experiments, Apple is focusing on the long-term integration of intelligent features directly into its products. This approach strengthens its competitive edge by making AI technologies accessible to its existing customers, who remain among the most loyal in the market.

iPhone 17 Sells Faster Than Its Predecessor

The main driver of Apple’s recent stock surge was the exceptional market success of the new iPhone 17 series, launched on September 19, 2025. According to Counterpoint Research, sales during the first ten days after launch rose 14% compared to the previous generation. Such demand for iPhone has not been seen in years. The biggest surprise is the base iPhone 17 model. In China, its sales nearly doubled compared to the previous model. Combined with strong results in the United States, this represents a 31% increase. The model features the new A19 chip with improved AI performance and other updates, while the price remains the same as last year’s version. In the U.S., the best-selling model is the iPhone 17 Pro Max. Its sales also grew faster than its predecessors, with carriers increasing subsidies and repayment periods. The new iPhone Air achieved notable success as well. It is the thinnest iPhone ever, measuring just 5.6 mm. After its release in China on October 17, it sold out within minutes.[1][2]

Did the China Visit Help?

Interest in the iPhone in China may have been supported by an October visit of Tim Cook, the CEO of Apple. In Beijing, he met with Vice Premier He Lifeng to discuss deepening cooperation, supply chains, and Apple’s future investments in the country. He also spoke at Tsinghua University School of Economics and Management, emphasizing Apple’s long-term commitment to the Chinese market and the need to balance innovation with user privacy protection. A key moment was his unexpected appearance on a live Douyin broadcast, where he promoted the iPhone 17 and announced the start of preorders for the iPhone Air. Shortly afterwards, Chinese regulators allowed three major carriers to test eSIM technology, removing the last obstacle to the device’s sale.

Amid escalating trade tensions between China and the U.S., Cook’s visit showed that Apple is not retreating from its regional strategy but doubling down. The country remains a crucial source of revenue and a manufacturing hub. During the meetings, Cook reaffirmed Apple’s commitment to continued investment and positioned the company as a reliable long-term partner for Chinese industry and consumers. This approach aims to mitigate geopolitical risks and prepare the ground for the introduction of AI-driven services and features that are not yet available in the Chinese market.[3][4]

Financial Results

For the Q3 of 2025, Apple reported revenue of $94 billion, a 10% year-over-year increase. Net income rose 9% to $23.43 billion. The iPhone remains the largest revenue source, generating $44.58 billion, while the Services segment also strengthened significantly, hitting a record $27.42 billion with 13% growth. Next came the Mac at $8.05 billion, the iPad at $6.58 billion, and the wearables, home products, and accessories segment at $7.4 billion. The company maintained a gross margin of 46%, demonstrating its ability to increase profitability despite rising production costs and geopolitical risks. Apple’s next earnings report is scheduled for October 30.

Another Milestone Within Reach

The company’s outlook remains exceptionally strong, suggesting that the $4 trillion market capitalization threshold may not be far away. Apple enters the final quarter with record demand for the iPhone 17, a rapidly growing Services segment, and the expected expansion of the Apple Intelligence platform, which could drive a new wave of device upgrades in 2026–2027. If it maintains its current growth pace and margins above 45%, only a single-digit increase in stock value would be needed to surpass the $4 trillion mark.[5]

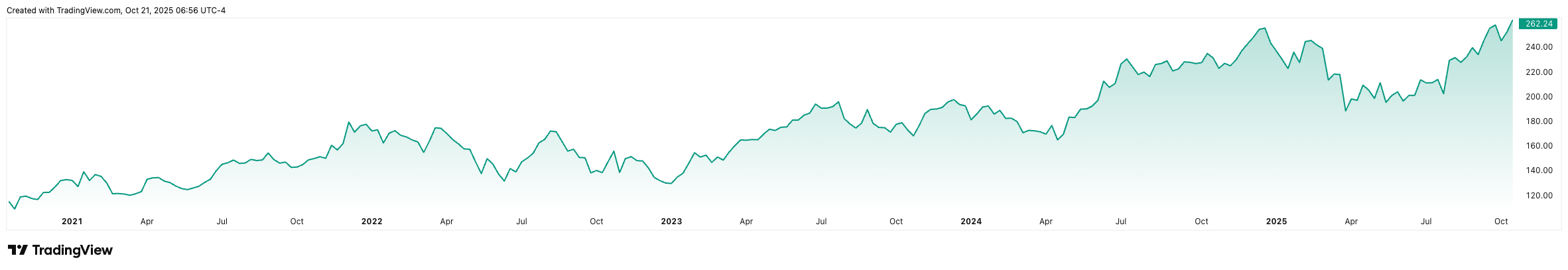

Apple stock performance over the past 5 years. (Source: tradingview.com)*

Conclusion

Investors view Apple as a stable pillar of the technology sector, capable of combining innovation with conservative financial discipline. A series of successful products, expansion into artificial intelligence, and rising service revenues create conditions for Apple to once again become the world leader in market capitalization, surpass the $4 trillion mark and remain there over the long term.

* Past performance is not a guarantee of future results.

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which is subject to change. Such statements are not a guarantee of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.

https://www.nasdaq.com/articles/apple-shares-jump-4-robust-iphone-17-sales-us-and-china

https://finance.yahoo.com/news/apples-iphone-air-sells-china-093000979.html

https://finance.yahoo.com/news/apple-ceo-tim-cooks-latest-093000725.html?utm_source=chatgpt.com